Overcoming the challenges and risks of cheque applications

Currently, the cheque deposit at teller couaCheque processing is beset with many challenges; rejection rate remains high due to poor technology applied in MICR encoding and reading, cheque fraud is difficult to detect due to poor technology applied in either cheque issuing or cheque clearing,nter is done manually ; both for data input and authentication. The current manual process is not efficient and secure; it takes too much time

Cheque processing is beset with many challenges; rejection rate remains high due to poor technology applied in MICR encoding and reading, cheque fraud is difficult to detect due to poor technology applied in either cheque issuing or cheque clearing.

Cheque fraud has been one of the largest challenges faced by banks and financial institutions. Its numbers have been increasing at an alarming rate. More and more criminals defraud their victims, including the banks, financial institutions or businesses that issue and accept cheques, as well as customers, either the account holder or the recipient.

In most cases, cheque fraud begins with the fraudsters stealing a genuine cheque before they alter some or even all the information on the cheque to their own benefits.

Cheque washing is a crime conducted by fraudsters by erasing all information on a cheque except for the signature which is either printed or written, with chemicals and other high-performance erasers. The information is then rewritten and misused to the benefit of the criminal.

Fraudsters tend to abuse genuine cheque leaves, most probably those from areas that have not implemented clearing automation systems, i.e. no MICR characters encoded on cheques.

Fraudsters may change all information, except the signature, on the genuine cheque with false information so that they can abuse the cheques for their own benefits. Otherwise, they may alter information, such as changing the customer’s account information on the cheque to the victim’s account information.

To hinder the detection of the altered information, fraudsters may imitate security features on the cheque (UV box) through utilizing special chemicals / tools.

Generally, information on the clear band of a legitimate cheque is encoded with MICR and can be read by an MICR reader. In case the information is not readable, the cheque, which may be using an E13B font can be suspected as fraudulent.

By observing a group of returned cheques, staff may suspect the cheque that possesses a slightly different colour than the rest of the cheques in the batch as fraudulent. Furthermore, with more thorough inspection, staff can find out that fraudulent cheque may be slightly damaged (with stains or discolorations) due to the force used to erase and alter the information.

Regardless of the chemical material and sophisticated technique applied in cheque washing, it is still possible to identify fraudulent cheques from the residue of the original information that remains on the cheque leave

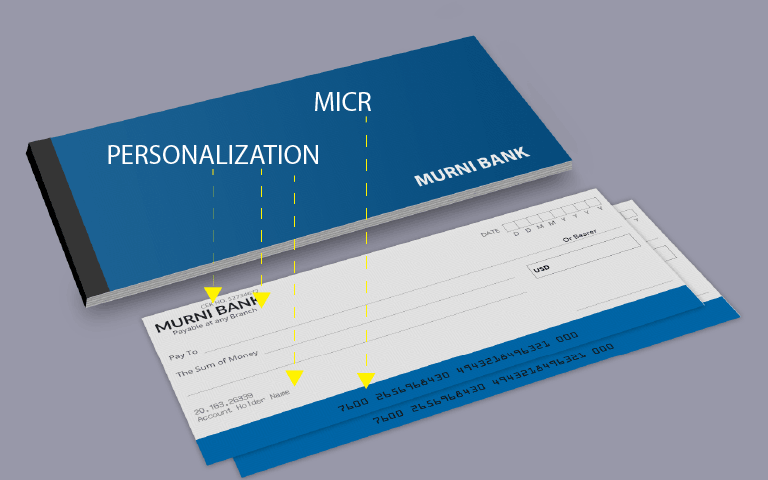

SMARTPERSONALISATIONTM

Chequebook Issuing Solutions

Chequebook printing with two security measures to prevent cheque frauds from both criminals and internal

SMARTENCODETM

Chequebook Encoding Solutions

Cheque encoding with impact printing technology.

SMARTCHEQUEENTRYTM

Teller Cheque Deposit Solutions

Automatic cheque scanning at teller counter, requiring no expertise or lengthy training of front-line staff/ tellers.

Notifications